Calculate the Payment of a Loan with the PMT Function in Excel

Thanks to Excel’s PMT function, computing the monthly payment of a loan with various terms is easy.

In summary, you provide the function with the basic loan information, including the loan amount, the interest rate, and the term, and the function will compute the payment.

You provide this basic loan information to the function through the function arguments, or parameters. There are actually five function arguments, three of the arguments are required and two are optional. An optional argument assumes a default value when omitted.

Video

Narrative

The function works like this:

=PMT(rate, nper, pv, [fv], [type])

Where:

- rate is the rate per period, and must be consistent with the nper argument and with the period you wish to return. In other words, if you want to compute an annual loan payment, then you should express this as an annual interest rate and nper should be expressed in years as well. If you are looking for a monthly payment, then you want to convert this rate into a monthly rate and should express nper in months as well.

- nper is the number of periods. This needs to be consistent with the period expected for the monthly payment and with the rate argument. If you want to return a monthly payment, express this argument in months, for example 360 for a 30 year term.

- pv is the amount of the loan, or, present value.

- [fv] is the optional argument for future value. In most cases, this will be 0 and since it is an optional argument if you omit it, the default value is 0.

- [type] is an optional argument to define when the payment occurs. 0 or omitted tells the function the payment is at the end of each period, and 1 means the beginning of the period.

Let’s see how this might work in a worksheet.

Let’s try to determine the monthly payment of a home loan.

We are borrowing $200,000 for 30 years at 4%.

Since we want the monthly payment, we know we need to express the function arguments in monthly periods. So, we would set up the function as follows:

=PMT(.04/12, 30*12, 200000)

Where:

- .04/12 is the annual interest rate divided by 12 so that it is expressed as a monthly rate

- 30*12 is the number of periods, 30 years expressed as the number of months

- 200000 is the amount borrowed

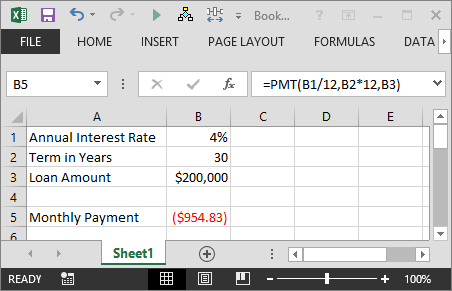

Of course, it is more likely that we would place the basic loan values into cells, and then use the cell references in the formula, something more like what is shown in the screenshot below.

For the most part, Excel’s financial functions work on a cash flow model, and since the loan amount is a positive inflow, the subsequent payments are an outflow. This is why the monthly payment amount is returned as a negative number. One small tweak is that we’ll flip the sign of the returned value by preceding the function with a negative, as follows:

=-PMT(B1/12, B2*12, B3)

- B1/12 is the annual interest rate divided by 12 to convert to a monthly rate, since we want a monthly payment to be returned

- B2*12 is the number of years multiplied by 12 so that the argument is expressed in months

- B3 is the amount of the loan

Thanks Microsoft!

Excel is not what it used to be.

You need the Excel Proficiency Roadmap now. Includes 6 steps for a successful journey, 3 things to avoid, and weekly Excel tips.

Want to learn Excel?

Our training programs start at $29 and will help you learn Excel quickly.

I came to the Blog to see if I can reinforce what I have learned.

Me too.

That’s me too. This is good to have handy.

This is a great function.

This is a wonderful resource. The blog helped to explain the payment function clearly.

Same here.

Ditto

As is the case in the classroom, Jeff you make it so clear and relevant in the BLOG format. THANKS.

Agreed! The PMT function will make calculating loans so much quicker and be helpful in real life.

Came over here from the online course to learn more about the PMT function. Thanks, Jeff!

Me, too. I used to use this all the time, but haven’t in years. Great refresher.

Great function – All these years of only using TValue. I hope to pick up many more useful functions throughout the course.

Yes, very useful function…Obviously not for compound interest..?

I wanted to see the further explanation/reinforcement on the PMT formula, you made the explanation on this exercise so clear and simple. Thanks!

This is a very useful function to know!

I’ve been using the payment function for a while. One tip: Make sure you use the round function if you are building a schedule of payments, like an amortization schedule. After all, a borrower can’t pay in increments less than a penny.

Very helpful!

The PMT formula is a powerful tool when its explained in a simple manner. Thank you!

Very interesting, and completely applicable

It’s really nice example. It’s very helpful. Thank you.

Use this function all the time in banking and financial analysis. Thanks

Will be useful in the future. Thanks.

This trick won’t only help me at work, but will help me with personal financial planning! Thanks Jeff!

This will definitely be helpful in the future…great comment!

Thanks. Very helpful.

I was surprised that you divide the percentage by 12 for the monthly amount. I totally would not have figured that out on my own. 0.4/12! It’s always good to study these functions in detail, or you may forget what goes where.

New information and the examples are great.

Clearly explained example – well stepped out so it is easy to follow- good explanation around required and optional values.

Great tip! I know I will be able to use this!

Thanks, very helpful.

Thank you very helpful. I know that I will be able to use this.

Excellent PMT function explanation. Thanks alot.

Thanks Jeff! Great formula to know!

1) Normally when we mention about interest rate and the term in our mind set – it refers to annual interest rate and annual term.

But to use the “PMT” function to calculate the constant loan payment – it refers to “monthly” payment. So, I re-construct the “PMT function” and find out it is very helpful for me to use as follows:

=PMT(annual rate/12, annual term*12, pv, [fv], [type])

2) Knowing “ loan received” as positive inflow and monthly” loan payment” as negative outflow are very beneficial concept.

The hardest part about using the PMT function is to make sure the rate and term agree. (I always forget to divide the annual rate by 12 when calculating a monthly payment!)

Great function! It is good to always be aware that a percentage rate is almost always given in annual terms, unless specified.

Nice to have!

A useful tool.

Interesting tool. I’m curious to put the info for my original home loan in and see if it works out to the same monthly payment. Something to try when I get home and have access to that info.

A familiar tool, but prefer lectures to reinforce concepts……thanks!

Thanks for the reinforcement!

Thanks once again for an informative post!

Jeff explained this function very simple. I am going to use it in future for sure.

Thank you

Explained the concept very easily.

Useful information, thank you.

Very easy to follow and understand!

Good to know! Thanks!

Love this function. Well explained, easy to follow, and useful.

Thanks.

Easy to use!

Fun exercise, thanks!

You have a way of explaining things to make them seem so simple!

Very helpful!

initially I was highly confused, but after reading through it (a few times) and opening a new sheet to put the formula to work – it makes perfect sense! love it!

That was a great piece of information!

I have to compute payments all the time. This really helps.

Great tip. Is semi-annual payments expressed by dividing the rate by 6 and the multiply the payments by 6?

Dwain,

Thanks! Semi-annual payments made twice per year would be accommodated by diving the annual interest rate by two and multiplying the annual number of payments by two.

Hope it helps!

Thanks

Jeff

Thank you for better explaining the PMT function. I learned this in my undergrad studies on a calculator and excel . Your post explains it very well.

Week one review. Have used this function for a long time, frequently as a part of a loan amortization table.

Good explanation of the simple interest calculator function.

what if we want to calculate the quarterly installment? the interest rate will be divided by what? and the period will be multiplied by what?

plz do reply

Hey Sachin,

All interest rates are stated in annual terms, so QUARTERLY is divided by 4 and the payment periods multiplied by 4.

Let me know if you need more help:)

Kurt LeBlanc

How would I use PMT function to calculate the amount of the quarterly payment required to repay the loan.

To determine the quarterly payment, enter the rate as quarterly (divide annual by 4), and number of payments to be the number of quarterly payments.

Clear and concise explanation. Thanks!

i thought this page was very helpful.

Great page!

Good to know. Very helpful

Thank you for the breakdown of exactly why each function is either multiplied or divided.

Cool! Where I work, we bought a separate software package that does that and present values and that sort of thing. We knew Excel was supposed to be able to do all this, but we could never get it to work!

its helpful

does this function presume the simple or compound interest rate?!

how did you get the monthly payments to show the value between parenthesis? when i did this function the result came negative like this -$85.61 ( in red). how did you make the negative sign like parenthesis (85.61)?

Hey Hassan

The formula uses compounding interest.

As for the negative value…it is a cash flow issue. The PV is positive, so the cash flow would have to be negative to equal $0 when its done: one in, one out. You can simply add a negative sign before the function (=-PMT) to change the negative result to a positive:)

Kurt LeBlanc

Very helpful, good explanation.

Useful formula!

thanks…. very useful

I am loving the wealth of information I have access to, this is yet another function I could see myself using regularly. Thanks!

SImple and clear explanation — per your usual style. Thank you!

I’m guessing that you left out the ROUND function to keep the example simple. I think you’ll agree that rounding is essential when dealing with money and multiplication — such as is involved with the PMT function — especially if you calculate more than one payment and then add them together. For example, rounding and displaying the result to the same number of decimal places assures that the total returned by Excel will be the same as it would be if you used a calculator to add up the displayed values. For anyone interested, Excel offers several types of rounding (e.g. round up, round down, round nearest) — go to the Excel help and search for ROUND for details.

Thanks for the comment about rounding 🙂

I have created worksheets the long, hard way. This will be very helpful.

I found the “ctrl + arrow” and “ctrl+shift+arrow” commands useful when working with large speadsheets.

Very useful info. Thanks Jeff 🙂

Very helpful!

Great tool!!!

Very helpful. Thanks for communicating this function in a way that could be easily understood!

Good to know.

Thanks!

Very useful. Thanks

Useful function

u r great .because I understood this pmt function after reading your post.thanks lot jf Sir

Thanks for the simplified explanation. Very useful for helping others, especially non accountants, to understand how loan payments are derived.

Useful function!

Thanks Jeff. Good to know!

Very detailed info for the PMT function.

Great refresher!

I knew some of the conditions in a function were optional. From this example I learned that the brackets [ ] designate which are optional.

Very good Lisa!

Kurt LeBlanc

Very useful and practical function!

great, thanks!

Very useful function!

Thanks for sharing this.

Very helpful. Thank you!

Great explanation of the payment function!

Thank you!

The PMT function is useful and quick and easy to use.

I’ll be using the PMT function now that I know about it

This will definitely come in handy Thanks!

useful formula

I see myself using the PMT function quite a bit in the future

Nicely done

PMT is one of few functions that I know.

Thanks for the PMT blog. Helpful. Merry Christmas!

Although it is useful to use Excel to compute when considering multiple scenarios, if only need to compute one, I prefer my TI calculator.

Learned something else new! Thanks

Used this a TON in my MBA Financial Management course!

Very helpful! Thanks!

I could see this as being useful in a repayment plan for a consumer. Those are unusual for us to have, so using something like this would make sense.

Followed the course to look for the PMY function. Dont know if I’ll use this much since I have TValue 5.

Great to learn the PMT function!

Nice to know, but not necessary to my business.

thanks for the information about PMT. I am pretty sure it will useful soon

I like your work of using the formula in an example. I did not know that the rate needs too correspond to the number of periods. (monthly rate for no of months in the entire period). Very good tip!

Great tool to use when contemplating large purchases. Will it fit in my budget?

I used this tool to help me decide on which student loan payment plan was best for me.

I appreciate the clarity of your blog post about the handy-dandy PMT function!

Not a function I use much but, nice to know.

Thanks for the tip

Thanks for the tip

Sent her from the Excel University class – good post!

Good post. Thank you.

This seems like it could come in handy, and is pretty intuitive to use.

We are currently refinancing, so this came in handy.

Thanks,

Marty

this will come in hand in refinancing.

Learning already!

Thanks Jeff for this helpful payment function insight!

Dear Everybody,

My name is Hai. I am from Viet Nam. I have a Excel’s problem (using PMT function) as below: “Mr. Adam wants to sign an insurance contract. He expects to earn $110000 after 18 years at 15% annual interest rate. How much money he must pay monthly for the insurance company, knowing that when signing the contract, Mr. Adam paid $10000?”

With my understanding, where:

rate: 15%/12

nper: 18*12

pv: 10000

fv: 110000

I tried calculate PMT in 4 formulars:

1. =PMT(15%/12,18*12,10000,110000) = ($235.03)

2. =PMT(15%/12,18*12,-10000,110000) = $33.31

3. =PMT(15%/12,18*12,10000,-110000) = ($33.31)

4. =PMT(15%/12,18*12,-10000,-110000) = $235.03

I do not know which formula is right. I’m very confuse in using PMT function, especially using PV and FV parameter sign (- or +). Could you explain to me the problem above? I’ve read Excel’ help and other examples on the web but still not sure exactly.

In general, for all the arguments, cash you pay out, such as deposits to savings, is represented by negative numbers; cash you receive, such as dividend checks, is represented by positive numbers?

Thank you so much for your help!

Sincerely yours,

Hai.

Hai, the PMT function is based on cash flow, where positive numbers are inflows and negative numbers are outflows. So the pv and fv are positive numbers, and the related monthly payment is expressed as negative.

Thanks

Jeff

Great info Jeff!

Great to know this function – it will be really useful, and is a lot less cumbersome than what I had been doing!

I had no idea the [ ]’s meant something was optional in a formula string. Great hint!

Very useful more for Personal Finances than day to day , I didn’t know about the [] being optional in formula’s either.

Great to see this up front! I have been working with my son to see how much car he can afford, and this will help us zero in on his heart’s desire!

Excel has lots of these great formulas. This is a handy one in particular

Love this! Glad to know about this formula – extremely useful.

Very useful to know this formula–thanks!

Will try it

Good explanation. I’ve been using this function for years. Doesn’t always = the lending institution but not off by much. I suspect they use actual days outstanding between payments received.

Great explanation particularly the two optional fields; have needed this formula for recent discussions.

Good concise explanation.

This function is very useful. I haven’t used it in a long time. Thanks for the reminder.

Thanks!

Thanks!!

Good stuff!!

Thanks, Ed.

Very interesting.

Easy to pick up on. Very accesible

Seems like a good function to know if you don’t have a financial calculator handy! Thanks!

Seems easy!

Thanks, Jeff.

Thanks Jeff

Thanks, Jeff

Very helpful! Thanks Jeff

Awesome and easy!

Good, good.

Thanks Jeff!

Make it easy to calculate.

This is easy to use. Thanks.

Can’t wait for the opportunity to use this.

Awesome stuff.

Reinforcement is always good, removes the rust.

Great tip.

While this can not help me as part of my job, it sure can help in my personal life!!! Thanks!

These formulas help with my home mortgage.

Easy peasy. Thanks!

Great function

Easy to understand as always Jeff. Thanks!

Great formula and information.

Thank you!

So easy to forget the simple functions that are super useful. Great outline of it here.

Thank you! Great information!

Continues to be a great function! Used it many times!

I learned this one in college, but a very helpful reminder. Thanks!

This will help me show my kids where they need to be in price and interest rate for the new car they want to purchase. Thanks!

This is a very helpful “cheat cheat” for those like me who are fairly new to Excel! It’s easy to forget or overlook the basics so this will be great to come back and look at!

Love the feature and use it when I remember it exists. Sadly, it’s often forgotten.

Good stuff as always.

This is great, so hepful

This is really great and helpful stuff

Nice refresher!

Very easy to understand!

Blog posts are a great tool for reinforcement!

I find the blog posts an excellent learning tool.

thanks for the shortcuts!

Great learning tools here!

Thanks for the shortcuts! They’re super helpful.

Thanks! They’re super helpful.

The PMT function is a great tool when comparing financing options on capital purchases.

Not sure if I will be using this in my line of work, but it’s good to know.

Very easy to understand, thanks!

Hi everyone im trying to use this formula,

i get 2 sets of values, when using the financial calculator and excel.

i have the following formula in excel

=PMT( 11%/12, 36, -276315.65, 166927.95, 0) Answer: R 5 111.39

=PMT( 11%/12, 36, -276315.65, 166927.95, 1) Answer: R 5 064.96

i used the calculator and my answers respectively are:

1. R 5 040.67

2. R 4 994.88

difference of +- R70.00

Anyone can explain why? and possible share a solution

Thanks a lot for some great information.

Thanks a lot for some great information!

very useful! Thank you.

This was very useful and thorough! Thank You!

Always nice to read about loan formulas. Hoping to encounter an article in the future dealing with a complete amortization schedule, possibly even one in which the interest rate changes throughout the course of the loan.

Hi Elizabeth!

I do have a couple of posts that demonstrate full amortization schedules, and although they don’t illustrate changing interest rates, that may be a nice idea for a future post 🙂

In the meantime, here are the prior posts:

https://www.excel-university.com/amortization-schedule-with-spill-ranges/

https://www.excel-university.com/create-dynamic-rows-for-an-amortization-schedule-with-power-query/

Thanks

Jeff

Very useful, Thank you

Very easy to remember and I’m sure it will be used a lot!

Great thank you!

This is my go-to formula for creating loan amortization tables!

Thanks Jeff for the reinforcement on a very handy function!

PMT is a very important excel function and you make it seem so easy.

I came to better understand PMT in excel.

I feel like I better understand the PMT function of excel after reading this article.

Very helpful!

Very helpful!

Use this all the time!

Very helpful!

Will give this a try.

Applying for a refi so this is very handy to know!

Glad to put what I learned into action!

This is a new function for me. Thank you!

Did not know there was a function but I have been using this formula to calculate payments.

Great explanation of the formula. Wish I had taken the time to learn this earlier.

Thanks for the article.

Came over here from the course to check on the blog! Will definitely save this for future reference.

Fantastic review!

Very useful explanation!

Thank you for the explanation

Is PMT applicable for monthly payment? i mean what if the borrower is not constantly paying his/her monthly due? like he is already 3 mos past due? how will i compute the total interest to be charge? is the interest in PMT applicable? thank you.

BINGO BANGO

Nice article. Thank you for sharing!

Thanks for this article. However, the Excel worksheet is not “shown below” the explanation, as stated.

Oh my … thanks for the heads up Linda! We’ll have this corrected.

Thanks

I have used the PMT function before in prior classes and have found it super cool and convenient! I am excited to use it for work but for now will continue to get better using it.

This is a very useful tool.

Seems like a great tool and can be used to make finance decisions.

Very helpful. Thanks!

Very useful function. Glad I know about it now!

Very helpful to have this additional explanation.

Very cool function

Good explanation

This is very helpful!!! Since our sons business needs to pay back a loan!! Now I can come up with some ideas and put this function to work!!!

Very helpful!

Good function to be aware of.

This should be a very helpful function.

This is a nice function in excel.

This is a good and helpful function to use.

Very useful function.

This function can save a lot of time

This is cool to know, and looks very useful.

This is vey helpful tool!

Awesome!

Thanks for the useful information.

great information. thank you

This is pretty cool. Thanks for the video!

Thank you!

Thankful I found this before I’ve bought my first house.

Now I’ll know how to estimate potential mortgage payments based on projected interest rate and term options! =D

This function is awesome, now I can create a real life budget and not half guess most of the time. As I am nearing retirement this would be very useful for a fixed income .

This is a great feature – wish I would have discovered the pmt function many years ago!

Excellent presentation as always

Great explanation of a useful function

one of my favs!

Great! I’m having so much fun learning Excel.

Thank you. I didn’t know I could do this with excel.

Wonderful explanation of converting to months, quarters, years, etc.

Just finished my 12th rep w/ that exercise sheet –

Repetition definitely = Mother of Mastery (tip o’ the hat to Tony R.)

It’s getting ‘funner’ w/ every rep 🙂

Hey Jeff! Thank you for sharing!

This function is so helpful!

This is a very handy function! Great for budgeting!